Need a real estate lawyer?

In the world of condominium ownership, the most critical aspect that owners and potential buyers must grasp is the monthly maintenance fee.

The monthly maintenance fee of a condominium can also be referred to as common expenses, common elements, CE payments, condo fees, strata fees, condo charges.

These fees ensure the operational stability of condominium properties. By understanding what condo fees include, how they are calculated, and the legal consequences associated with non-payment, condo owners and potential buyers can navigate their financial responsibilities and whether these types of homes are right for them.

What do condominium fees include?

Condo fees typically include several components that collectively cover the costs of maintaining and operating the condominium property as a whole:

Utilities

Condo fees often include certain "bulk metered" utilities which vary based on the condominium structure and arrangements.

There is no standard requirement. However, it's most common to see Water and garbage/recycling disposal included in condo fees.

Electricity and gas are less commonly included, but some condominiums, particularly older ones can include them within the fee.

When a utility is not included in the monthly maintenance fee, the owner is simply billed for their usage, similarly to a freehold property.

Sometimes internet services and Cable TV packages are included, or provided at a discount with a group agreement.

Reserve Fund

A portion of the condo fees go into a "reserve fund". A reserve fund is a pool of money that is set aside and dedicated to the future major repairs, replacement, and maintenance of common elements and assets located on the property.

Basically, the reserve fund serves as a financial cushion or safe-guard to ensure that the community can afford major unexpected expenses without resorting to sudden, large-scale special assessments on homeowners.

Common Area Maintenance

The bulk of the condo fee calculation focuses on the upkeep and maintenance of the common areas within the condominium property. Things like:

- Hallways;

- Lights;

- Parking Structures;

- Elevators;

- Gyms etc.

This portion of the condo fees may also include calculations for funds that are to be used to pay for any ongoing agreements the condominium corporation has with third party companies with respect to the maintenance of the property.

Landscapers, management companies, snow removal companies etc. make long term arrangements with condominium corporations to upkeep the property with the costs being dispersed amongst the unit owners.

It is essential for potential buyers, current owners, or real estate lawyers to review the breakdown of condo fees provided by the condominium association or management company in the status certificate to understand exactly what is covered and to budget accordingly.

Need a real estate lawyer?

How Condo Fees are Calculated

Condo maintenance fees are necessary for the upkeep of common areas and shared amenities within condominium developments. Typically, the common expenses are determined on a per-unit basis factoring in the percentage of square footage "owned/used" by the unit owner.

For example, a person with a 2 bedroom unit with 2 parking spaces may pay more in common expenses than someone in a bachelor in the same complex as the 2 bedroom unit quantifies more of the complex, uses more common resources, and may contribute more wear and tear than the bachelor. ie. the 2 bedroom unit is bigger.

The fees are calculated based on several key factors including:

- Operational Costs: This includes expenses such as cleaning, landscaping, snow removal, security services, property management fees, and in some cases property taxes, as well as other like considerations.

- Reserve Fund Contributions: As noted above, a portion of the fees are allocated to the reserve fund, which is used for major repairs and replacements of common elements over time.

- Condo Corporation Budget: Each year, the condo corporation prepares a budget outlining anticipated expenses for maintenance, repairs, insurance, administrative costs, and other operational needs.

Condo Fees in the First Year

During the first year of occupancy or ownership the condo fees are estimated by the developer building the condominium property and are addressed with the initial budget (sometimes referred to as the "Disclosure Statement").

Newer condominiums, or pre-construction condos, will often have higher initial fees due to startup costs, the initial buildup of the reserve fund, and any necessary infrastructure adjustments.

These initial fees are typically re-worked and adjusted after the first year of operation based on the actual expenses. At the end of the first year, the corporation will review actual expenses versus the budgeted amounts and identify any discrepancies, adjustments are then made to future fees to better align with the actual operational costs and reserve fund contributions.

Condo Fees After the First Year

After the initial year of occupancy or ownership, the condominium corporation will take over from the developer and the Board will regularly assess, review and adjust the fees to ensure they cover ongoing operational expenses and future maintenance needs.

The overall expenses of the corporation will be divided by twelve to calculate monthly payments and further split amongst the unit owners.

Annually, the corporation should conduct a thorough review of its budget to accurately reflect current and anticipated expenses such as:

- Operational Costs;

- Inflation and Cost Changes;

- Per Square Foot Adjustments; and

- Unexpected Repairs etc.

In that review, the corporation should also conduct a full review of the reserve fund and determine the need for any increase.

Reviewing the reserve fund studies, projected costs analysis, and updated legislation may result in subsequent contribution adjustments critical for the day to day operations of the condominium development.

Need a real estate lawyer?

Defaulting on Condo Maintenance Fees

When a unit owner fails to pay their condo fees on time they are considered to be in default. Defaulting will often result in the following steps to be undertaken by the condo corporation:

- Late Fees and Interest: Initially, the owner will be charged with late fees and accruing interest may be imposed on the overdue payment.

- Notice of Arrears: The corporation typically sends out a notice of arrears to the owner, detailing the amount owed, and stipulating the amount of late fees and interest.

- Lien on Unit: If the delinquency persists past a certain amount of time, and pursuant to the Condominium Act, 1998, SO 1998, c 19, s 85, the corporation may exercise its right to register a lien against the unit. This lien can negatively affect the owner's ability to sell or refinance the unit until the outstanding fees are settled.

- Legal Action: If all previous attempts to resolve the default are unsuccessful, the corporation may choose to take further legal action to collect in a manner that is similar to proceedings on a defaulted mortgage. This could involve a claim being brought against the owner resulting in court judgements or enforcement measures, such as wage garnishment or bank account seizure.

- Restrictions on Use of Common Elements: In some cases of non-payment, the corporation may restrict the delinquent owner's access to common facilities such as parking areas or recreational amenities pursuant to the Condominium Act, 1998, SO 1998, c 19, s 134.

- Foreclosure: In extreme cases, the corporation may have no other option but to initiate foreclosure proceedings against the unit owner.

When reviewing a status certificate, pay special attention to the condominiums rules, by-laws, and declaration for specifics pertaining to the above.

Factors that Affect Condo Fees

Condo fees vary based on several key factors that impact operational costs and overall financial management of the condominium corporation:

Building Age

Older condo buildings typically require more frequent repairs and maintenance due to aging infrastructure, like plumbing, electrical systems, roofing, and structural elements. These maintenance needs can drive up operational costs and consequently the per unit condo fees.

In addition to general upkeep, the complexes overtime will require upgrades such as improvements to meet updated building codes, increase energy efficiency, and maintain the aesthetic appeal of the property.

Technological upgrades, like retrofitting older buildings with modern technological systems (e.g., HVAC upgrades, energy-efficient lighting) can also increase initial and ongoing operational costs, impacting condo fees.

Amenities in Building

The amenities offered within a condominium complex can significantly influence monthly maintenance fees. Factors like the types and quality of amenities and the demand for certain amenities can drive the cost of condo fees up or down depending on their availability and desirability within the community.

For example: Condominiums with extensive amenities such as swimming pools, fitness centers, spas, concierge services, landscaped gardens, and recreational facilities incur higher operational costs.

These amenities require regular maintenance, staffing, utilities, and building insurance coverage. Maintaining high-quality amenities like these require investment in durable materials, regular upkeep, and periodic refurbishment to ensure they remain attractive and functional for residents.

High-demand amenities may necessitate more frequent upgrades and maintenance to meet residents’ expectations and regulatory requirements. For example, pool maintenance involves water treatment, cleaning, and safety inspections, which incur ongoing costs.

Size of Building

The size and scale of a condominium development impact maintenance fees in several ways.

Larger condominium complexes may benefit from economies of scale in certain operational areas, such as bulk purchasing of utilities or negotiating service contracts at lower rates per unit. This can help mitigate some maintenance cost increases.

Larger buildings will often require more extensive management and maintenance staff to oversee daily operations, respond to maintenance requests, and ensure the upkeep of common areas. The payroll and benefits associated with additional staff contribute to higher operational costs.

Larger buildings typically have more extensive common areas, including corridors, lobbies, elevators, and parking garages, which require regular cleaning, lighting, security, and repair services.

Need a real estate lawyer?

How much do condo fees cost?

The cost of condo fees in Ontario can vary significantly depending on several factors such as the location, size of the unit, amenities provided, age of the building, and the financial health of the condominium corporation.

Toronto Condo Fee Comparison

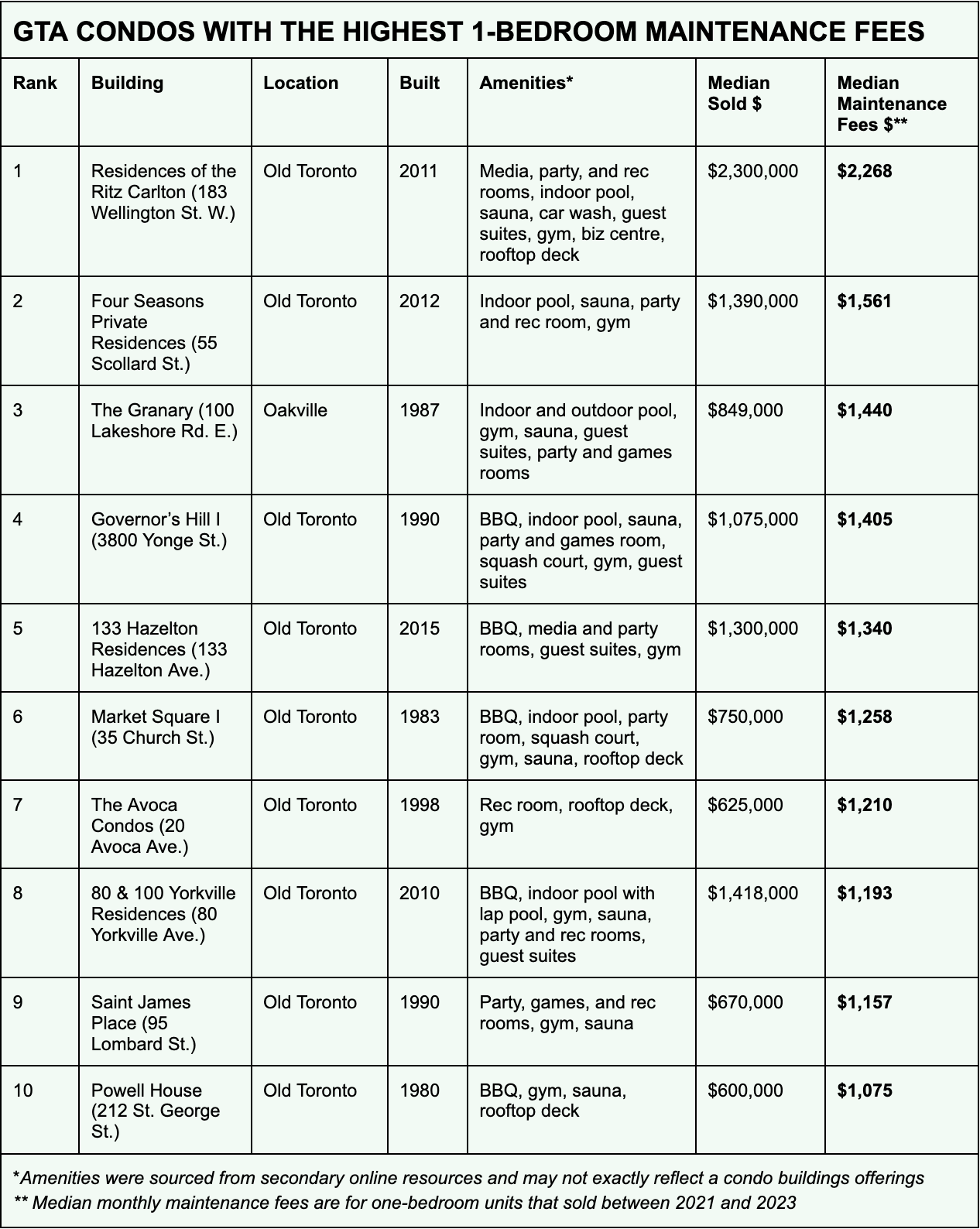

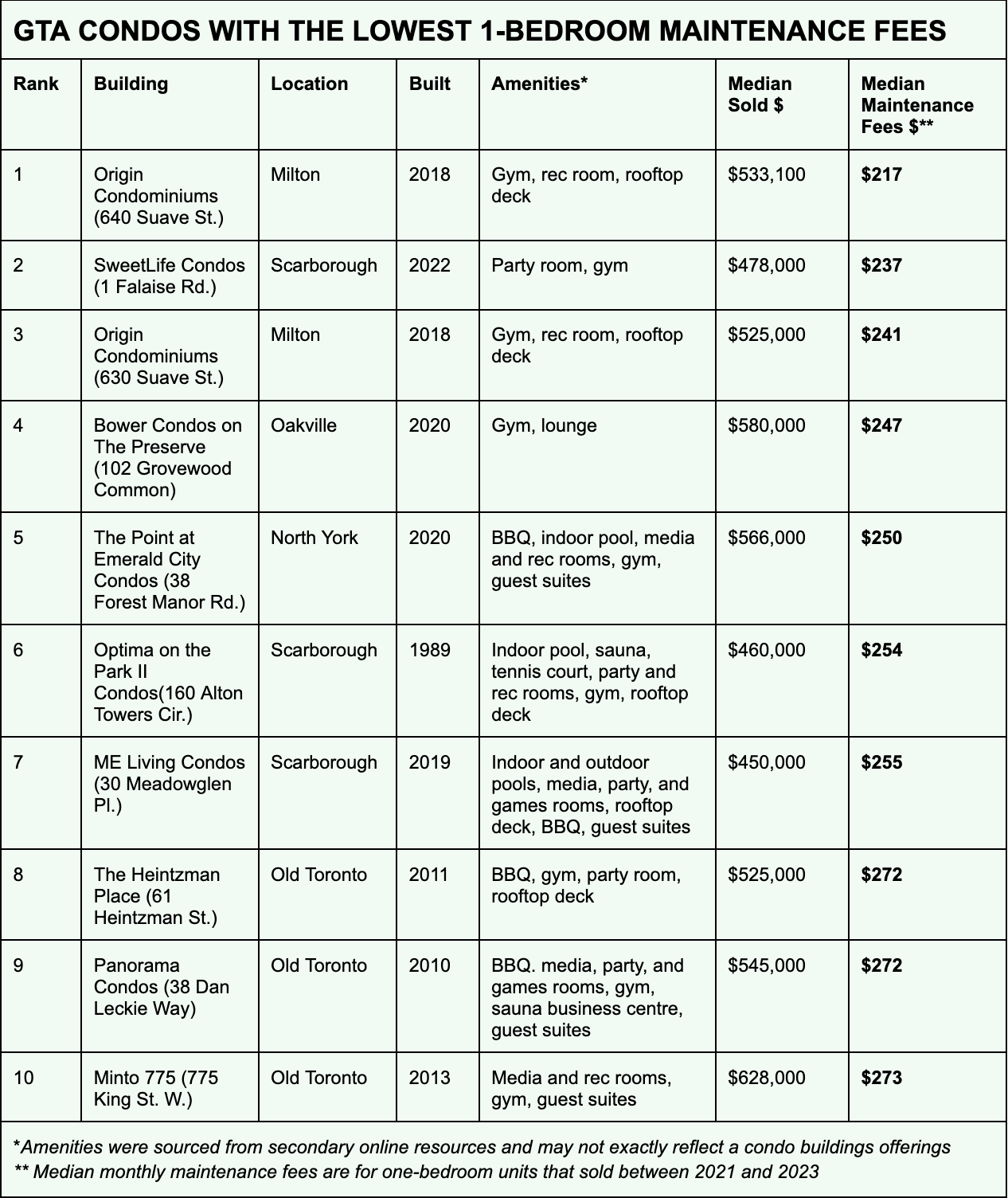

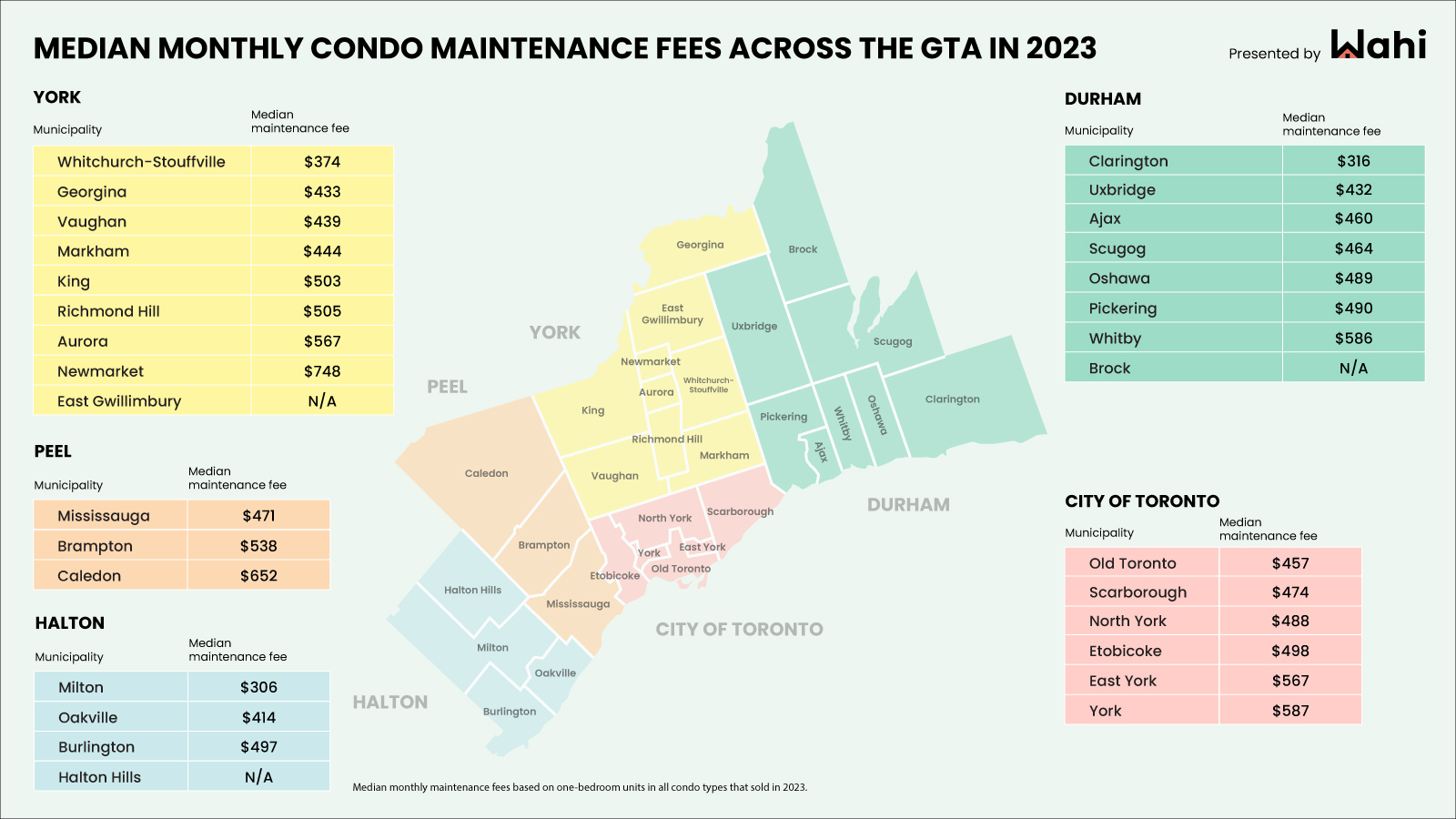

For Ontario real estate lawyers and prospective condo buyers, comparing maintenance fees across Toronto neighbourhoods and building types can provide valuable insights:

- Neighbourhoods: Fees often vary notably between downtown areas such as the Financial and Entertainment Districts, and suburban regions like North York and Scarborough. Factors influencing these differences include proximity to amenities, access to public transportation, and local property values.

- Building Types: Comparing fees among luxury condos, mid-range developments, and more affordable options offers perspective on the varying costs associated with living in different parts of the city.

|

|

|

Need a real estate lawyer?

Summary

Understanding condo maintenance fees is essential for condominium owners and prospective buyers in Ontario. These fees encompass various expenses necessary for the upkeep and operation of shared spaces and amenities within condominium properties.

From utilities and reserve funds to common area maintenance and legal implications of non-payment, grasping these elements helps ensure financial responsibility and preserves the value of one's investment. For detailed guidance tailored to specific condominium matters, it's advised to consult with an experienced real estate lawyer.

Contact Us

If you have questions about Condo Maintenance Fees or any other real estate legal matter, we're here to help. As real estate law specialists, our mission is to provide the clarity and direction you need to protect your property rights.

Contact us today to schedule a free consultation.

Zachary Soccio-Marandola

Real Estate Lawyer

Direct: (647) 797-6881

Email: zachary@socciomarandola.com

Free Consultation

Frequently Asked Questions (FAQ)

What is the average condo fee in Ontario?

According to The Toronto Star in an article published in March of 2024, the average condo fee in 2020 was 73 cents per square foot, or roughly $475 per month for a 650-square-foot home. Fees increased 2.98 per cent in 2021 and 2.72 per cent in 2022, and then 5.51 per cent from 2022 to 2023. The owner of that 650-square-foot unit would now be paying $620 more per year compared to 2020.

Are condo fees tax-deductible?

In Canada, condo fees are generally not tax-deductible for individual unit owners. These fees cover operational costs and maintenance expenses of common areas, which are not considered personal expenditures directly related to income-generating activities. However, according to the CRA, "If you earn rental income from a condominium unit, you can deduct the expenses that you would usually deduct from it. You can also deduct condominium fees that represent your share of the upkeep, repairs, maintenance and other current expenses of the common property."

Can I negotiate or dispute my condo fees?

Condo fees are determined collectively by the condominium corporation and are usually based on the budget approved by the board of directors. While individual condo owners cannot typically negotiate fees, they can participate in meetings where budgets are discussed and approved. Disputes regarding fee increases or mismanagement can be addressed through internal condominium dispute resolution processes or legal channels.

How do I know if my condo fees are reasonable?

To determine if your condo fees are reasonable, consider factors such as the size and age of the building, types and quality of amenities provided, local property values, and the financial health of the condominium corporation. Reviewing the breakdown provided in the status certificate and comparing with fees in similar buildings in the area can provide insights into the fairness of your fees relative to others.